WE MAKE CREDIT EASIER. END OF STORY.

We focus on creating custom financing solutions, which include revolvers, term loans, and equity co-investments. We can handle longer-term investments because we are supported by a depository funding model.

Profitable private equity sponsored companies with an EBITDA between $2 to $15 million and an EBITDA margin exceeding 10%

Revolvers

Classic Senior Term Loans

Senior Stretch Facilities

Equity Co-Investments

Credit facilities of $10 to $60 million

Aerospace/Defense

Consumer

Distribution

Healthcare

Manufacturing

Services

Technology

Private equity sponsored

Family office-owned

Proven management team

Strong financial performance

Sustainable, recurring cash flow

Defensible competitive advantages

Based in North America

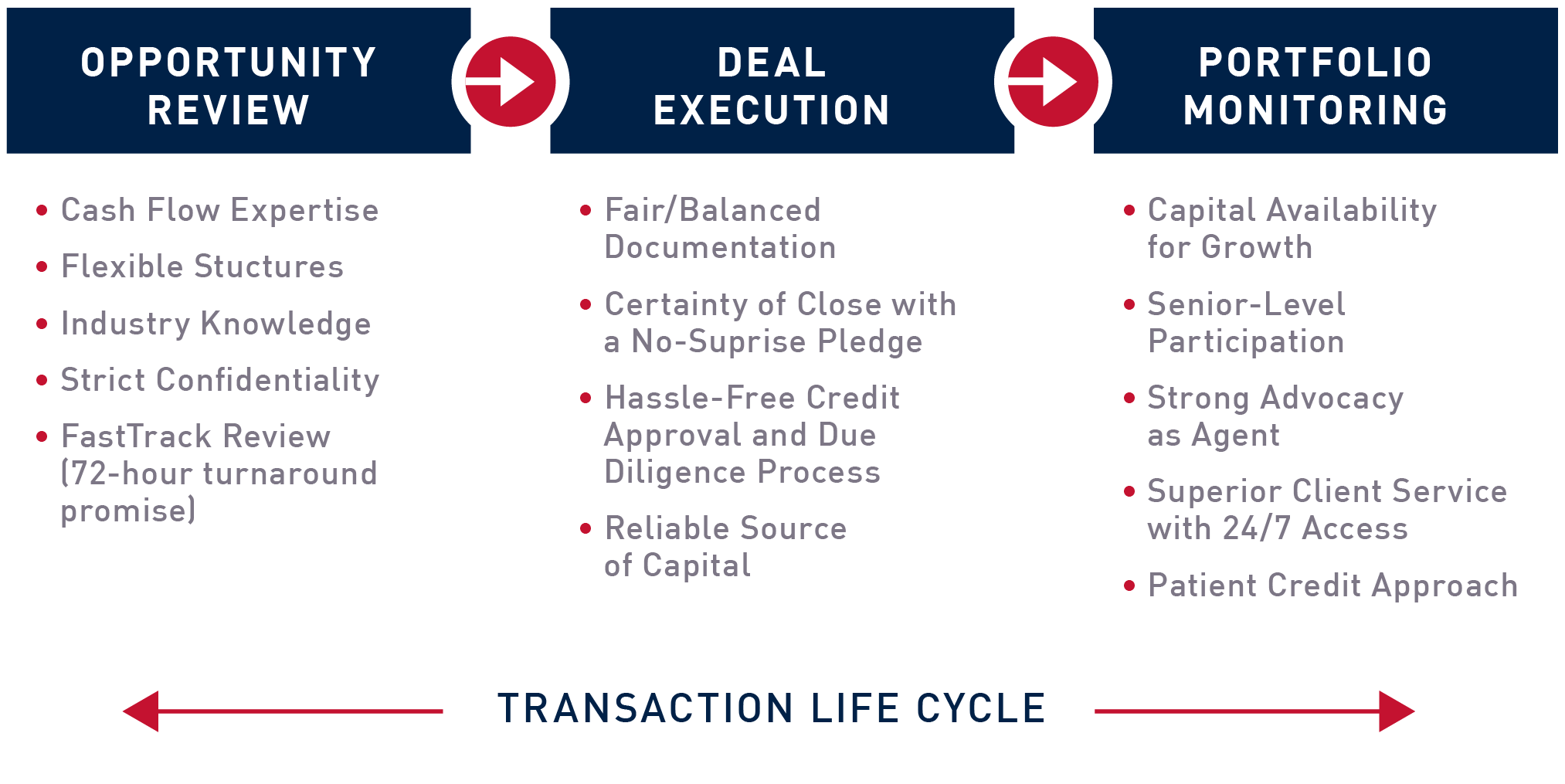

An eye for detail does not mean we work slower. Our team’s deep industry knowledge combined with an obsession for efficiency results in a turnaround time of under 72 hours. This swift response time is just one part what we call our Total Partnership Approach™ – a comprehensive methodology that reflects our emphasis on growing relationships rather than just focusing on the number of transactions.

Our resources, experience, and proven approach make us a true partner in private equity. We invite you to learn more about us from the private equity sponsors who have counted on us.